Wilmington Trust Newsroom

Press Releases

The latest news from Wilmington Trust.

Forecast examines the headwinds facing the U.S. economy, the shift from capital appreciation to yield, and the reemergence of emerging markets

WILMINGTON, DEL — Wilmington Trust released its annual Capital Markets Forecast titled “The Wheat from the Chaff: Obstacles and Opportunities,” which explores three central themes the investment team predicts will influence both U.S. and global economies in 2016 and through the next decade.< /p>

The first theme Wilmington Trust’s Investment Committee examines is the continuing economic leadership of the U.S., despite the threat of growing headwinds including high public debt levels, constrained growth, and adverse demographic changes. The second theme is a shift in investment philosophy from capital appreciation to yield due to a low-return environment. The third theme looks at growth potential in emerging markets as innovation and middle-class consumption evolve in positive trajectories.

“This past year was neither the best of times nor the worst of times. While calling the markets turbulent could be an understatement, the end result was rather flat,” said Tony Roth, Wilmington Trust’s chief investment officer. “We expect to see more of the same in the near term and, not surprisingly, this constrained growth is likely to effect a shallow recession within the next five years.

“Longer term, the economic trends we’ve identified for 2016 will evolve and be transformative over the next decade.”

U.S. Economy Strong … For Now

The U.S. economy to outperform other developed economies through 2016, despite the persistence of constrained and uneven growth. Positive elements include strong employment numbers, stronger wage growth, increased business investment, and higher government spending.

Two potential domestic obstacles in 2016 are housing and exports. The housing market is likely to be impacted by the Federal Reserve’s interest rate hikes. The effect should create more of a dampening than a collapse of the housing market, however.

Similarly, the rise in interest rates should have an inhibiting effect on exports and manufacturing. Strong appreciation of the U.S. dollar over the past two years hampered exports and domestic manufacturing. The dollar should continue to appreciate in the near term, but less dramatically than in 2014 and 2015. Despite this, any additional appreciation will still create negative pressure on exports and manufacturing.

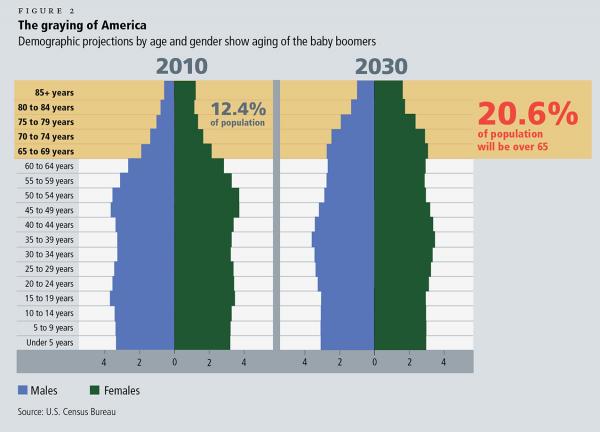

In the longer term, the Investment Committee expects the U.S. will be profoundly affected by on-going demographic shifts. The world’s largest developed economy runs the risk of stagnant growth due to low reproductive rates, the graying of America, and a talent shortfall due to immigration cutbacks.

“The key contributors to economic growth—labor force expansion, capital investment, and productivity increases—are trending downward and won’t sustain meaningful growth for the United States,” said Luke Tilley, Wilmington Trust’s chief economist. “While we expect productivity gains to continue to elevate modestly, productivity alone won’t be enough to fuel America’s economic growth.”

Preeminence of Income in a Low-Return Environment

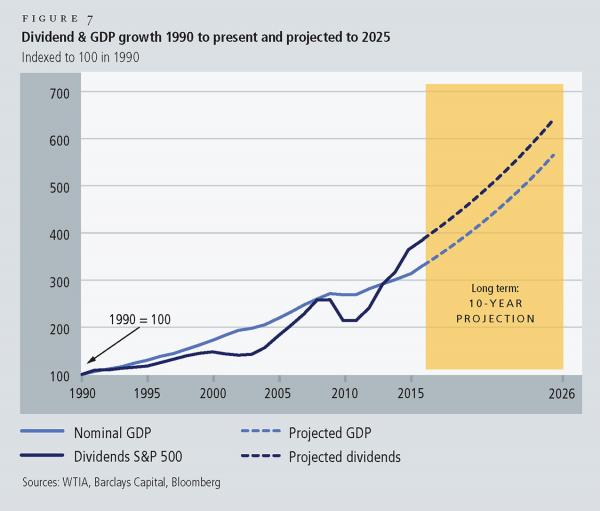

Income will reign supreme when focus on capital appreciation shifts to yield as a low-return environment becomes the norm. Despite domestic markets setting all-time highs in 2015, stocks ended the year essentially where they started. The investment team sees the shift in market momentum as a sign of existing or impending full valuation based on earnings and cash flows.

As yield rates edge higher and expectations for overall capital appreciation to range between moderate and negative, income should become a significant part of the return stream. To take advantage of the income trend, effective strategic investment allocation is imperative. In pursuing income, few markets can compare to high-yield bonds, however, intrinsic risks involving credit quality and defaults requires thoughtful risk management. This is especially important since the Investment Strategy Team foresees a recession within the next few years which could prompt an increase in defaults.

Persistently low inflation should temper both short and long-term interest rates. This should, in turn, create a flattening effect on the yield curve, with shorter rates moving higher as overnight rates are normalized. Expectations are for the Federal Reserve to continue to hike rates, but at a cautious, deliberate pace.

Reemergence of Emerging Markets

Emerging markets, such as China, India, and Brazil, are expected to create many investment opportunities over time. Corporate transformation and expanding pools of middle-class consumers may position emerging markets as better geographies for robust stock returns than more mature markets like the U.S., Europe, and Japan.

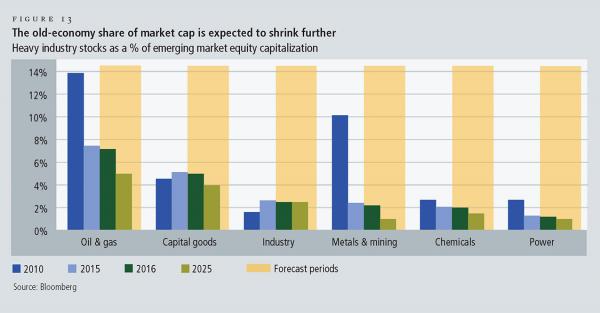

The principal obstacle to emerging market growth is the legacy of “old economy” industries focused on commodities and resources, such as oil and gas, metals and mining, capital goods, chemicals, and power. The majority of these firms were established as state enterprises, and continued to be saddled with bureaucratic state influence. They lack the flexibility to meet the increased consumption of the emerging middle class.

The share of old-economy companies has diminished over the last five years, and this trend should intensify over the next decade, making way for innovative and consumer-focused “new economy” industries. New-economy firms, established by entrepreneurs rather than governments, can more nimbly serve rising consumer demand. Ultimately, these new-economy industries have the potential to drive explosive growth in the emerging markets investment space.

To read more insights from the 2016 Capital Markets Forecast commentary and view video commentary from members of Wilmington Trust’s Investment Committee, please visit WilmingtonTrust.com/CMF.

Investment products are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by Wilmington Trust, M&T, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Wilmington Trust is a registered service mark. Wilmington Trust Corporation is a wholly owned subsidiary of M&T Bank Corporation. Investment services, wealth advisory, and corporate and institutional products and services are offered by Wilmington Trust Company, operating in Delaware only, and Wilmington Trust, N.A., a national bank. International corporate and institutional services are offered through our international affiliates.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.