Wilmington Trust Newsroom

Press Releases

The latest news from Wilmington Trust.

Forecast explores the subtleties of U.S. economic cycle, mystery of growth despite weak inflation, and the potential resurgence for alternative investments

WILMINGTON, DEL—Wilmington Trust released its Capital Markets Forecast for 2018 titled “Global Positioning Systems: Recalculating in Light of Detours, Bumps, and Blind Spots.”

The outlook examines three key themes: the emergence of a late-cycle economy in the U.S., the mystery of inflation and growth from a domestic and global perspective, and the potential for alternative investments to prosper against a backdrop of rich valuations, low yields, and higher volatility.

“As we began our annual reading of the economic tea leaves, the dominant question was whether the bull marathon will finally take a breather,” said Tony Roth, chief investment officer for Wilmington Trust Investment Advisors, Inc. “Based on our analysis, we believe the economy will continue to grow in 2018, so the bear will slumber for another 12 months or longer.

“This cycle continues to defy historic trends. Yet, despite the continuance of paradoxical market factors, we expect organic economic growth of 2.25 percent, with the potential of additional lift from tax reform. Adding in the manufacturing sector recovery and favorable credit conditions on the back of weak inflation, we see little reason to expect a turn for the worse.”

The U.S. Economy: Late-Cycle Emergence

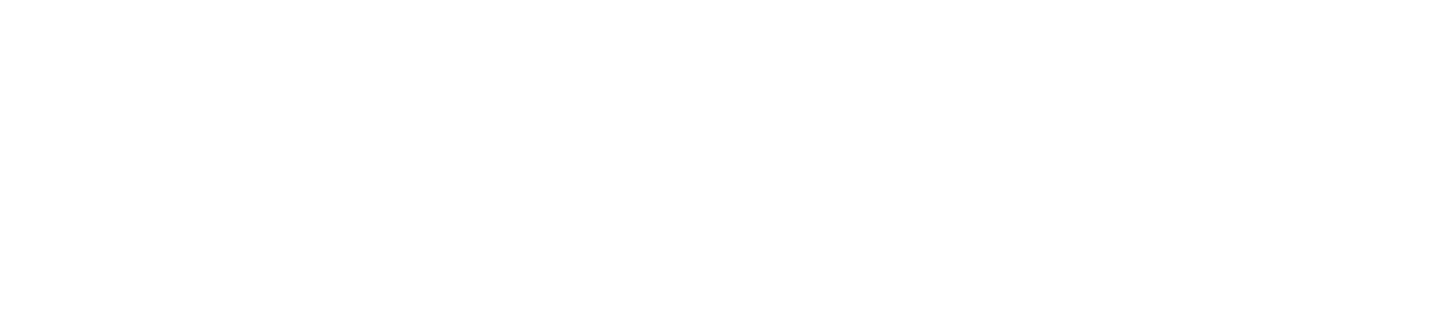

The omission of inflationary pressures throughout the economic recovery is a baffling phenomenon to both investors and policymakers. Despite unemployment rates dropping to levels not seen since 2001 and the market climbing more than 65 percent from its pre-recession peak, inflation continues to miss the Federal Reserve’s 2-percent target.

Wilmington Trust believes the low inflation environment indicates the U.S. economy is in the middle stage of the economic cycle, which is shaping the firm’s recommendation for maintaining an overweight approach to equities, and being underweight to fixed income. However, U.S. equity valuations are the highest they’ve been since the tech bubble in 2000.

High valuations can be unnerving, but are poor predictors of near-term returns. Additionally, in previous cycles the combination of low interest rates and low inflation has been supportive of higher valuations.

“The U.S. appears to still be moving along in the middle part of the economic cycle, but the flickering signs of a late cycle can be seen on the horizon,” said Luke Tilley, chief economist at Wilmington Trust Investment Advisors, Inc. “Elevated valuations, a tight labor market, wage acceleration, and a flattening yield curve all speak to inevitable transition to the late cycle. For now, low inflation is likely to keep us tethered to the middle a little longer.”

Inflation and Growth: Global-U.S. Divergence

The U.S. is still trudging through the middle cycle, but it is only one of the few major national economies exhibiting late-stage signals. Many other countries have endured subsequent, though less severe, recessions during the past decade as the U.S. economy consistently grew. Most international economies are exhibiting earlier stage signals such as low inflation, high unemployment, and central banks that are easing monetary conditions.

Credit growth, another important indicator of economic health, has diverged noticeably between the U.S. and international counterparts. From 2012-2014, the U.S. saw an acceleration of total credit growth in the private nonfinancial sectors. U.S. credit growth plateaued over 2015-2016, but still remains healthy.

In contrast, other developed international economies have seen credit growth appear much later. Credit expansion in the eurozone and Japan only began to pick up in 2016, and emerging markets even later. The exception is China, where the economy continues deceleration from high rates of growth fueled by government stimulus.

Another divergence between domestic and international economies can be seen in equity valuations. U.S. valuations remain high, while global equity markets are growing at a more reasonable pace. Wilmington Trust recommends an overweight approach to international equity due to the attractiveness of the valuations and prospects of return.

Valuations, Yields, and Volatility: Alternative Resurgence

The outlook for returns appears lackluster. Elevated equity valuations, coupled with the long recovery, suggest poor return prospects in 2018 and beyond. This does not mean a healthy allocation to stocks is unwise, but investors should reduce their medium-term return expectations.

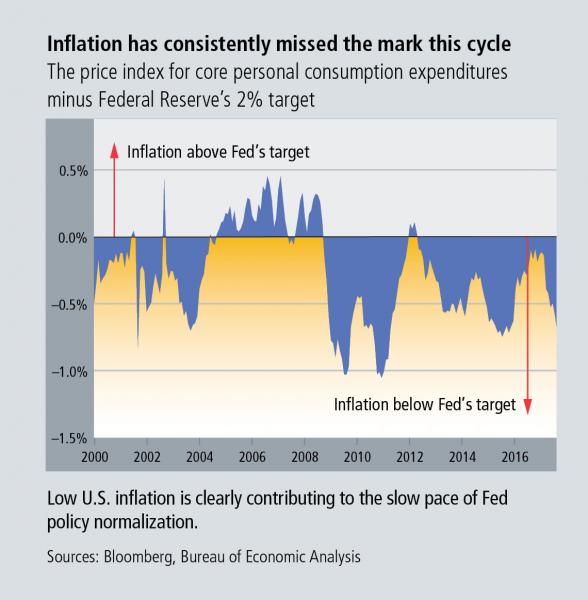

Yields are expected to remain depressed globally in 2018. Bonds will likely remain pricier than the stock market and provide less income, yet U.S. government bond yields eclipse those of other large industrialized countries, and are on par with some emerging nations, which generally come with greater risk. Investor demand for U.S. debt over other developed nations is capping long-term yields, a trend likely to continue as major central banks maintain easier monetary policy than the Fed.

Volatility is likely to rise. Even though volatility remained surprisingly low in 2017 amidst a backdrop of significant geopolitical risks, Wilmington Trust believes low volatility to be unsustainable, and likely rising to normal levels in 2018.

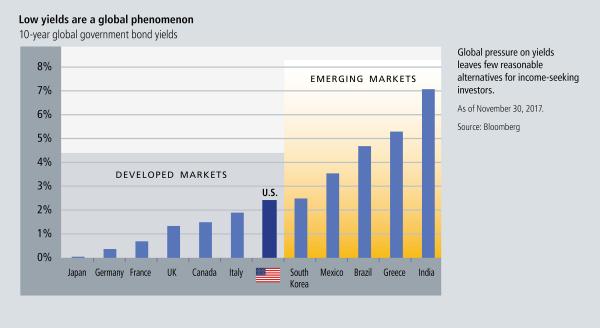

Due to the combination of high valuations, low yields, and higher volatility, Wilmington Trust believes it will be difficult to attain a moderate rate of return and a healthy income stream via customary investment vehicles. These circumstances warrant greater allocations to alternative asset classes at some point in the near term.

Investors should seek investments that offer great diversification and undifferentiated return streams such as liquid alternatives, hedge funds, and private equity.

Risks to the Outlook

Wilmington Trust identifies three primary risks to the outlook:

- Monetary policy: e.g., Fed raises rates too much or too quickly without sufficient evidence of stronger inflation, or falls behind the curve as fiscal stimulus galvanizes the economy more than expected.

- U.S. policy: e.g., legislative failures disappoint markets, or policy misstep regarding NAFTA.

- Geopolitical risks: e.g., international concerns rise, especially in light of threats from North Korea, or increased conflict in the Middle East.

To see more insights from Wilmington Trust’s 2018 Capital Markets Forecast, please visit our CMF landing page, which includes the full forecast commentary, videos, disclosures, and more, online at WilmingtonTrust.com/CMF.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.